Support CleanTechnica’s work through a Substack subscription or on Stripe.

BEVs reach 21% market share!

EVs are picking up in Europe, with some 399,000 plugin vehicles being registered in Europe in September, which is the second best month ever for plugins, only behind the 412,000 units of December 2022. Expect December 2025 to establish a new record score, maybe even above the 425,000 unit mark.

The overall market also had a positive month in September, rising a sharp 11% YoY to 1.2 million units, which is a significant departure from the YTD performance, which is up by just 2% YoY.

Interestingly, this 11% growth rate is happening solely due to electrified powertrains, with HEVs rising 16% YoY, to 35% share; BEVs up by 22%, to 21% share, or some 265,000 units; and then the highlight being PHEVs, which saw their sales jump 59% YoY, their highest growth in over three years, to some 135,000 units, or 11% of the total market.

On the flipside, in September, petrol was down by 8% YoY, to 24% share, while diesel dropped even faster, down 16% YoY, to … 6% share.

Yep, gone are the days that diesel had +60% market shares in Europe….

Adding the 35% market share of HEVs to the 21% of BEVs and the 11% of PHEVs, this means that 67% of all new cars in Europe had some sort of electrification.

Despite the positive month, the year-to-date numbers for BEVs remained at 18% (28% for PHEVs and BEVs combined).

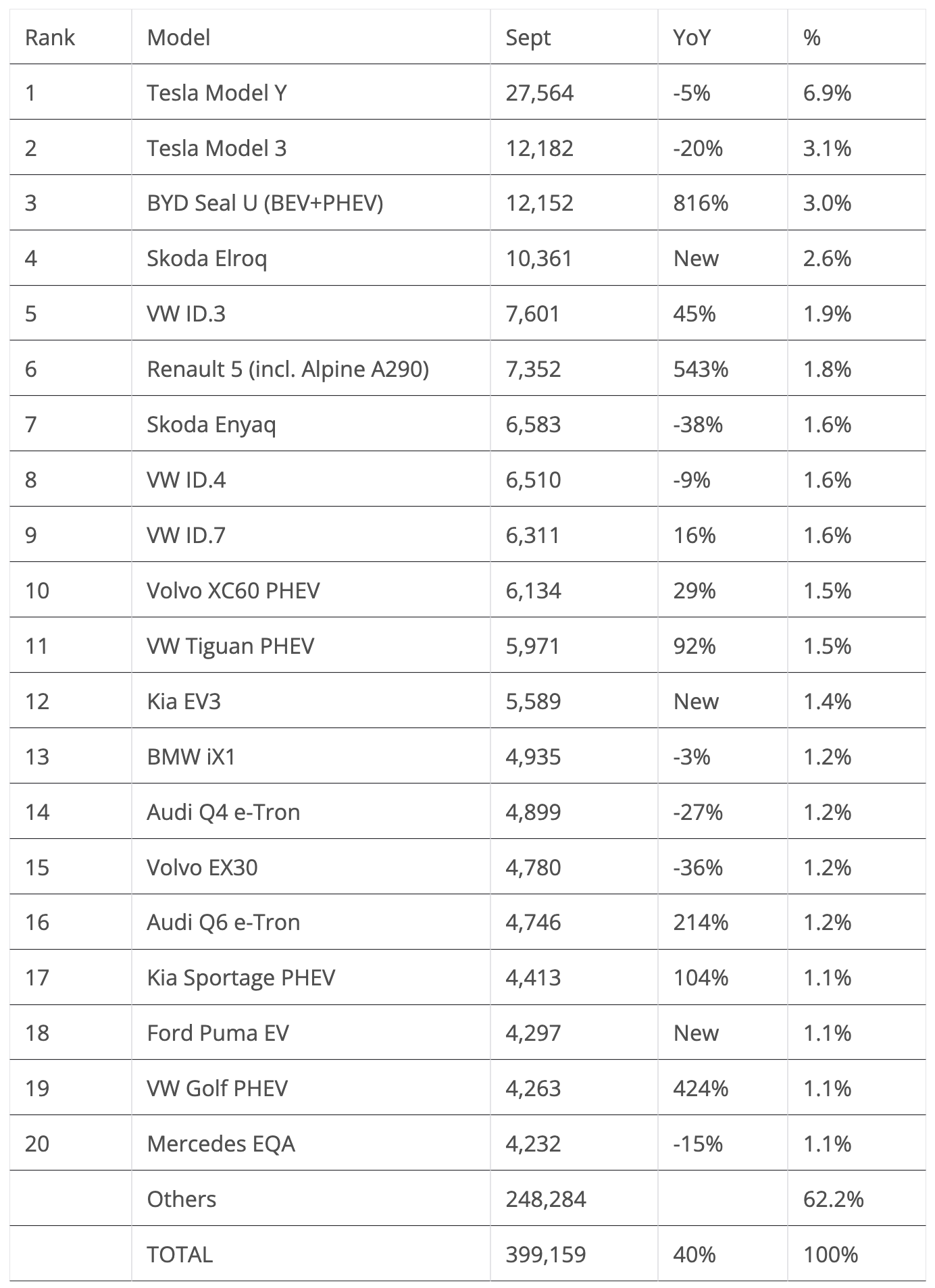

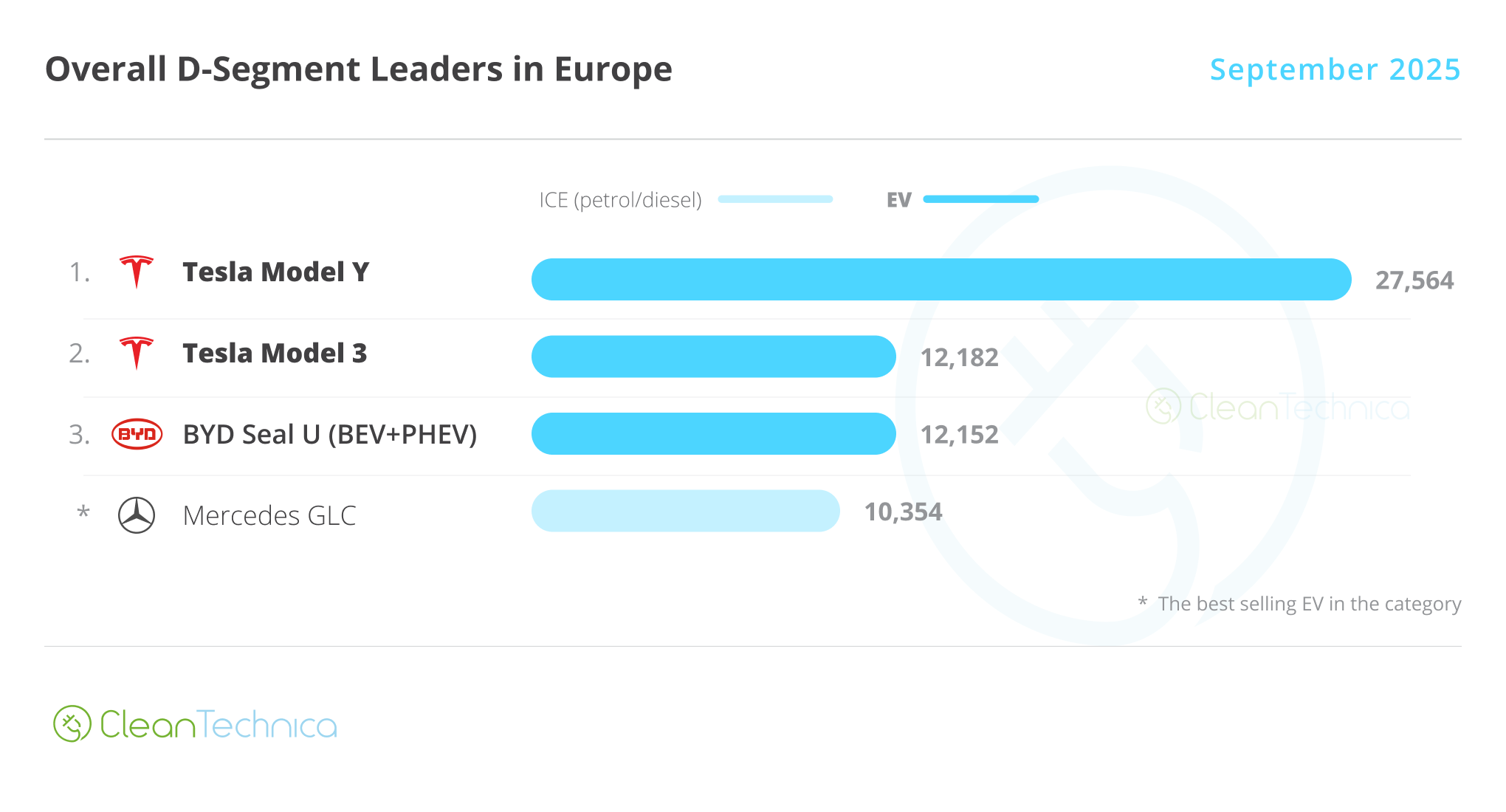

Looking at the best selling models, the big news this month was Tesla winning the #1 and #2 spots. Although, the Model 3 had to sweat to stay ahead of the 3rd placed BYD Seal U (European version of BYD Song). Here’s a more detailed analysis of the top 5 EVs this month:

#1 Tesla Model Y — Tesla’s star player delivered 27,564 sales, with the crossover thus winning its first top seller trophy of the year in the overall market in September. Still, looking at the yearly performance, the decline is visible compared to last year, with the crossover’s +20% decline in sales YoY putting it only 17th in the overall ranking, which is a far cry from the 4th spot earned in 2024 in the overall model list in Europe. Back to September and the plugin list, with a small 5% drop in sales, the Model Y won this month’s contest without a sweat, more than doubling the result of the #2 Tesla Model 3.

#2 Tesla Model 3 — Tesla’s sedan had to compete until the end to earn 2nd place, ending the month with 12,182 registrations in September. Despite being enough to win the silver medal, that still meant a significant 20% sales decrease YoY. Gone are months like September 2021 (25,592 registrations)…. Still, despite being an 8-year-old model, the Model 3 still has enough attraction (and inertia…) to stay among the best sellers, thanks to competitive specs and pricing. With the competition increasing by the day, it will become more difficult for the Texan brand to achieve two presences on the podium. At 61,000 units delivered this year, the Model 3 is back to 2022 sales levels, a time when BEVs were selling half of what they are selling today….

#3 BYD Seal U (BEV+PHEV) — BYD’s midsize SUV is having a moment in Europe and managed to win a podium presence thanks to a record 12,152 registrations in September. Still, with the BEV version representing less than 10% of its sales, the backbone of this performance is the PHEV version. With prices starting at less than €40,000, the PHEV Song Seal U has an 18 kWh battery as well as fast-charging capabilities, and while it does not seem like something out of the ordinary, look at the competition: the VW Tiguan PHEV (20 kWh battery, CCS charging), starting at €52,000; the Kia Sportage PHEV (14 kWh battery) starting at €45,000; and the outgoing Toyota RAV4 PHEV (18 kWh) at €52,500. Looking at that, one starts to understand the value for money appeal of BYD’s SUV. You buy one with your head, not your heart. (Or, for the latter, BYD has the more appealing Sealion 07 SUV.)

#4 Skoda Elroq — The recently introduced Elroq won another top 5 presence in September, thanks to 10,361 registrations, its first 10,000+ score. And I bet it won’t be its last … Volkswagen Group has struck gold with this one. Despite minimum effort (basically, it shortened the Enyaq), Skoda won a regular top three presence. Although not as spacious as its bigger sibling, it compensates for that with a competitive price, starting at just €34,000, which makes it one of the cheapest compact crossovers on the market, Chinese included. Could this be the new value-for-money king?

#5 VW ID.3 — The German hatchback is finally living up to its promise, winning another top 5 position in September thanks to 7,601 registrations, its best score since June 2024. Benefitting from a refresh, and a significant price cut to help things along, the VW model saw its sales jump over 45% in September, allowing it to become the best selling electric hatchback in September. Expect the Volkswagen EV to continue running at a pace of some 6,500–7,500 units per month, and winning several top 5 presences as a result.

Outside the top 5, with September being the second strongest month in history, there were several models shining and placing record performances.

Starting in the Volkswagen stable, it was time for two of the make’s classics (not the Beetle nor the Breadvan) to score record results. The long running VW Golf PHEV, which debuted 11 years ago, in 2014, had its best score ever in September, with 4,263 registrations. That allowed it to join the table in #19. Meanwhile, its crossover sibling, the 6 year old VW Tiguan PHEV, also hit a record score, in this case, of 5,971 registrations. With both models recently benefiting from competitive specs (20 kWh battery, CCS charging, over 100 km electric range), they are experiencing a second youth (make it a third youth in the case of the Golf), allowing them to reach unprecedented sales.

They are good examples of what a usable PHEV should be (personal note: a few days ago, I saw a Golf GTE charging at a Tesla Supercharger and thought: “What? Can they do that?!? Oh, right … it’s one of the new ones …).

Another model joining the table was the #18 Ford Puma EV. With a record 4,297 sales, Ford’s little crossover with a big trunk is finding its spot on the market, which just raises the question — will we see a future Ford Fiesta EV based on the upcoming VW ID.2? Fingers crossed….

Finally, the Volvo EX30. While on paper the September performance (4,780 units) was bad — after all, it was down 36% YoY — this was the small Volvo’s best score since moving the European production to Gent, Belgium. So, will the good looking Swede be back to last year’s sales levels soon, now that production is ramping up at its new home? A lot of watchful eyes are looking at this particular model, as it’s the first model to change its production site due to the EU’s tariffs….

The fate of it might help others decide whether to move EV production to Europe.

Outside the top 20, the highlights were aplenty, starting with the Mini Aceman. Basically a 5-door version of the Mini Cooper EV, it scored a record result, 2,793 registrations, making it the best selling Mini EV in the lineup.

The Cupra Tavascan also hit a record result, 3,735 registrations, and the Cupra Born’s result (4,096 units, a new year best), highlighting the Spanish brand’s good month. Meanwhile, the VW ID.BUZZ continues to … buzz around, scoring yet another record performance, thanks to 2,957 deliveries.

Could these numbers move product managers into offering more MPVs in Europe? I mean, I believe we have already had our share of SUVs by now….

Mercedes saw its brand new rangetastic CLA BEV have its first full month on the market, with the streamlined Merc scoring 3,860 registrations already. So, things look promising for the new three-pointed-star EV, even if it is at the cost of making every other BEV in the lineup look a generation behind….

Polestar saw its 4 crossover-coupé-hatchback-thingy score a record 3,011 registrations, providing much needed volume to the Sino-Swede brand.

Regarding Chinese EVs, as one would expect, record scores were plentiful, with the most important belonging to BYD (Sealion 07 — 3,476 units; Dolphin Surf — 2,288 units), SAIC’s MG (S5 — 2,524 units; eHS PHEV — 3,939 units), and Chery’s Jaecoo 7 (3,903 units).

An interesting note on Chery’s Europe strategy: while other Chinese makes prefer to go at it with one main brand (BYD, MG, etc.), Chery is doing it with three different brands (Jaecoo, Omoda, and Chery itself), with more on the way (Lepas…) — and there is little to no differentiation between them. A winning strategy? It surely looks different….

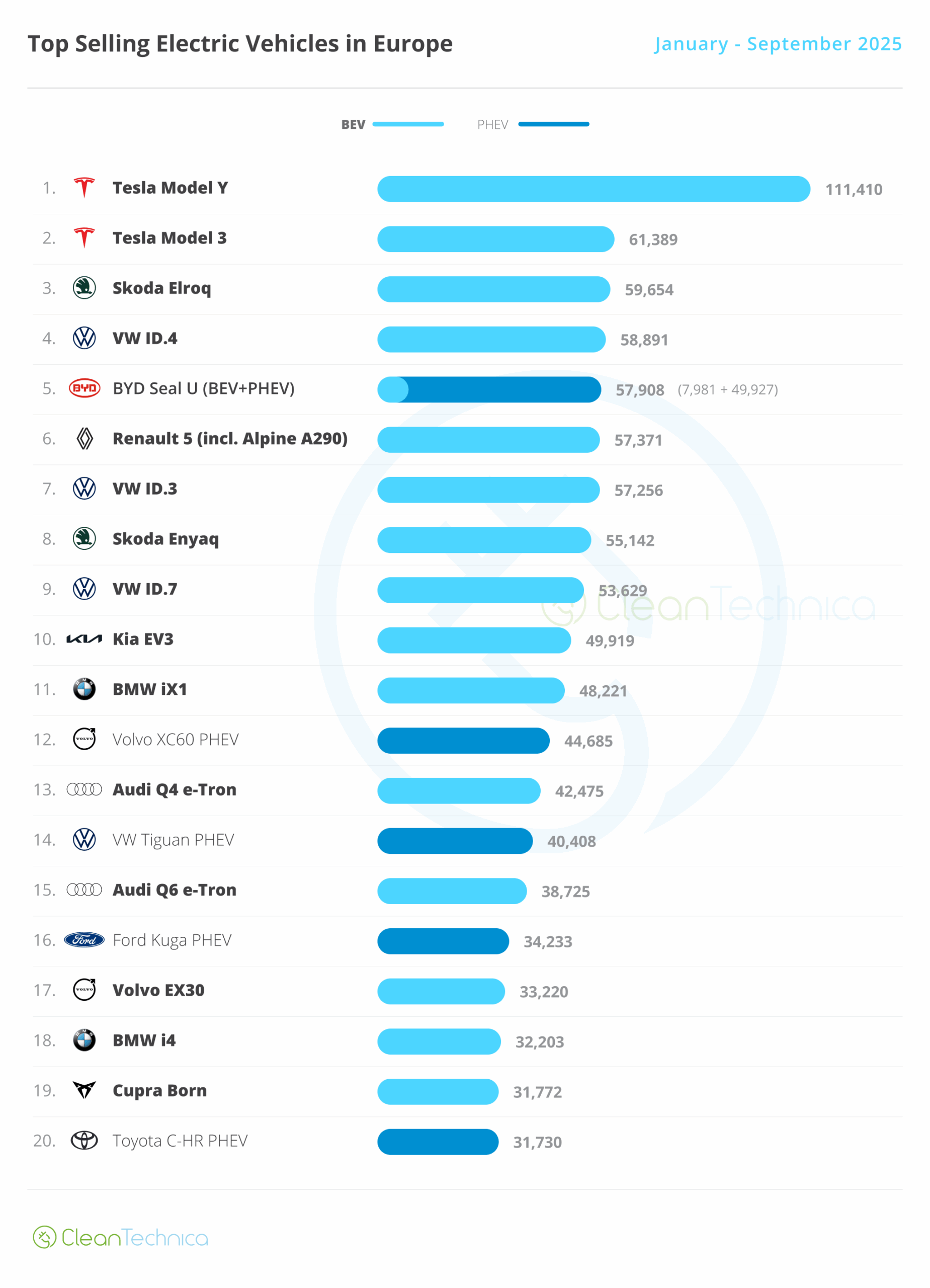

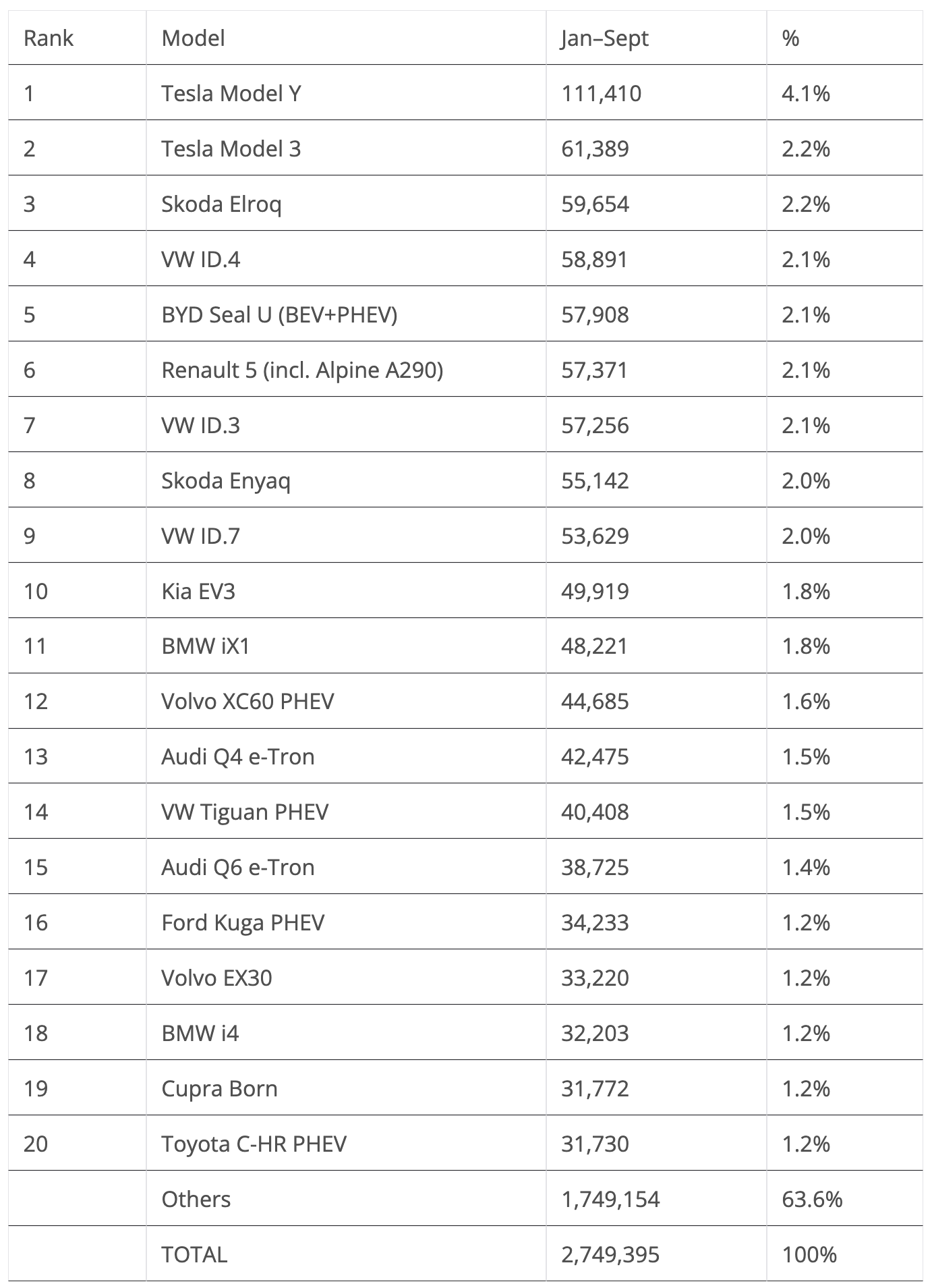

Looking at the 2025 ranking, there were big changes in the top positions.

While the Tesla Model Y remained untouchable, behind it, a lot has happened. The Tesla Model 3 and Skoda Elroq both rose several positions, to 2nd and 3rd, respectively. A few positions back, the BYD Seal U also jumped, going from 9th to 5th in just one month, making the European top 5 now look much closer to the global one.

With 4,000 units separating the 2nd placed Tesla Model 3 from the 7th placed VW ID.3, it will be an interesting 4th quarter, with six candidates competing for two podium positions. Although, to be frank, only three of them really count — the #2 Tesla Model 3, the #3 Skoda Elroq, and the #5 BYD Seal U, as they seem to be the only ones able to add over 20,000 units in the last quarter of the year.

How will they split the positions? Hard to say, but if I had to place my bets, it would be the Skoda in 2nd, the BYD in 3rd, and the Tesla in 4th. To be continued….

Elsewhere, there was no other position change on the table, with the only close race to follow in October being the one for the 19th spot, with the Cupra Born defending its position from a #20 Toyota C-HR PHEV just 42 units behind.

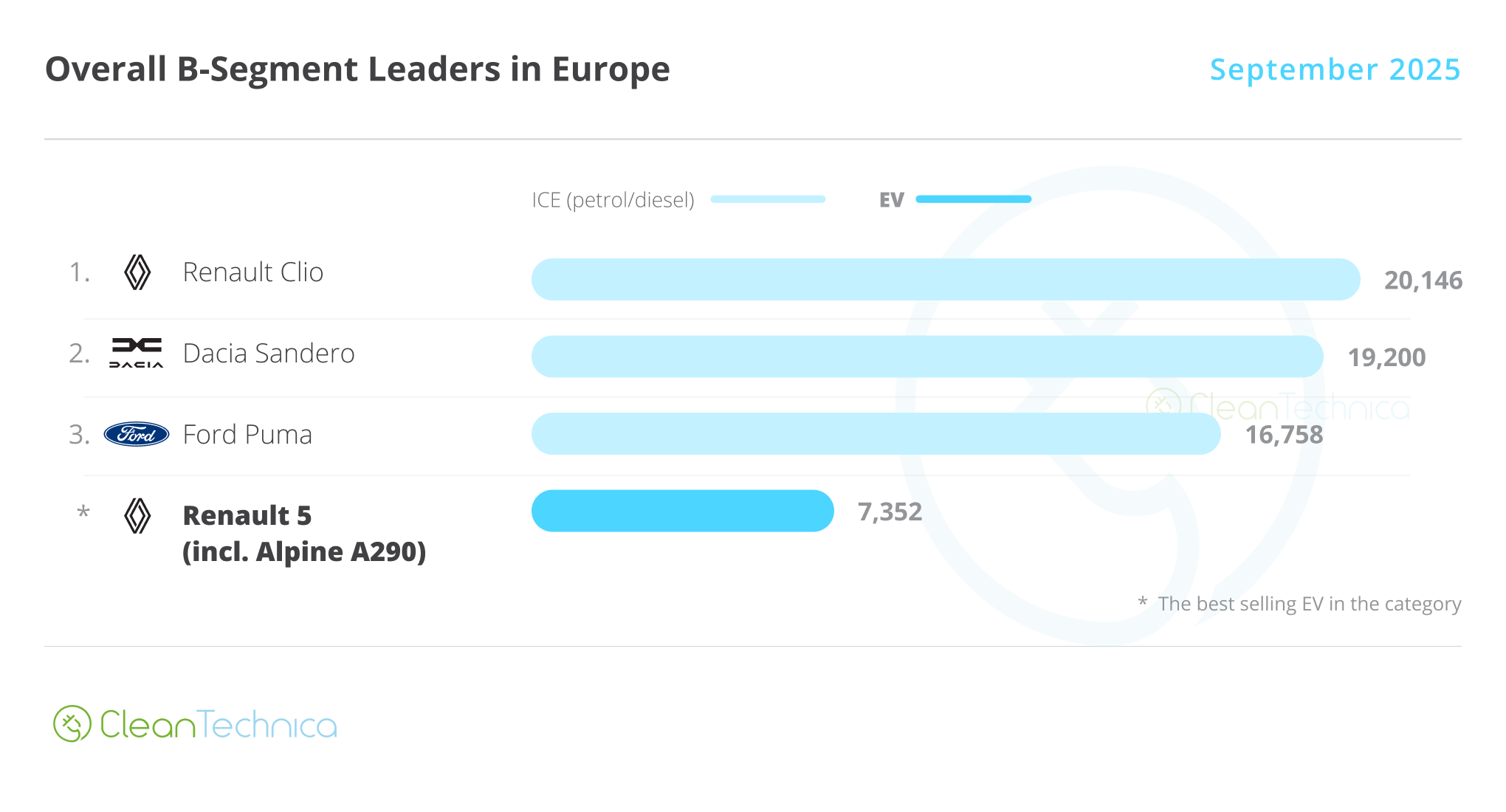

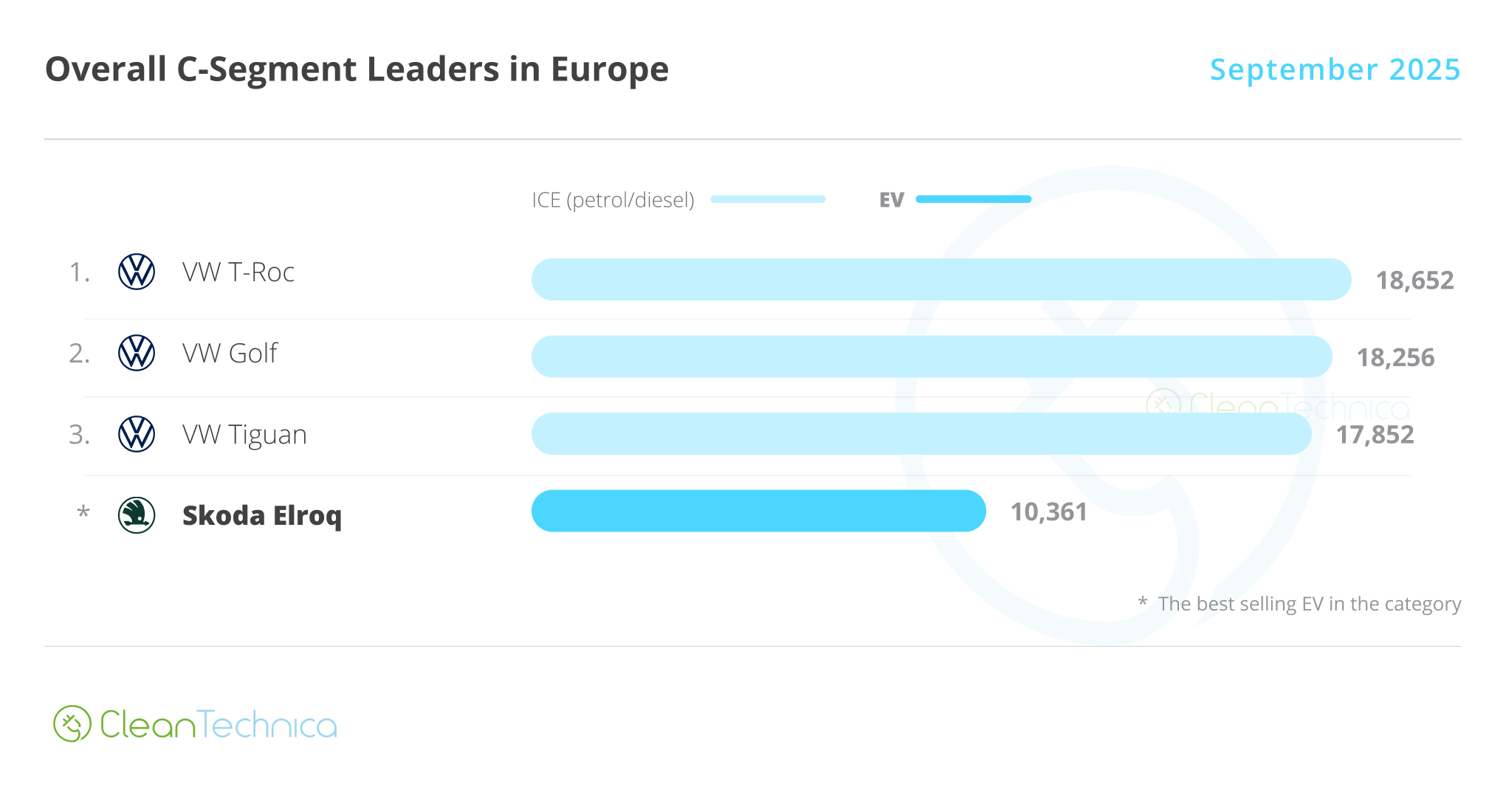

Comparing September’s overall best sellers to the plugin best sellers by size category, one can see a contrasting trend:

- In the D-segment (midsize category), all top three sellers are plugins (#1 Tesla Model Y; #2 Tesla Model 3; #3 BYD Seal U), with the best selling ICE model, the Mercedes GLC, ending the month in 4th. And even this one is only partially ICE, as 39% of its sales are coming from the PHEV version.

- In the C-segment (compact category), the podium is all ICE, but with two of them (VW Golf and VW Tiguan) having a significant part of their sales coming from their PHEV versions (23% for the hatchback and 33% for the crossover).

- As for the B-segment (subcompacts), the picture is even more ICE dominant, as only one of the podium bearers is partially electrified (26% of the Ford Puma sales derive from the BEV version).

Complementing this information, and highlighting the fact that electrification becomes less prominent as we go down in size (and price), the best selling city EV, the Dacia Spring (2,899 units), represents just 25% of the total sales of the category’s overall winner (Toyota Aygo X — 11,446 units). That figure grows to 37% in the B-segment (Renault 5 vs Renault Clio) and 56% in the C-segment (VW ID.4 vs VW T-Roc).

Having a quick look at September’s overall brand ranking, besides Tesla being the only brand to see its sales fall (-12% YoY) on the table, the highlights were the rise and rise of Chinese makes, with the Middle Kingdom OEMs growing 149% YoY in September and grabbing a significant 7% share of the overall European market. The two fastest growing makes in the top 20, coming from Chinese OEMs, were #15 MG (up 62%) and #20 BYD (surging 404%).

Outside the top 20 (but maybe not for long…), we have Chery’s Jaecoo in #27, posting an exponential growth rate YoY (5,776%).

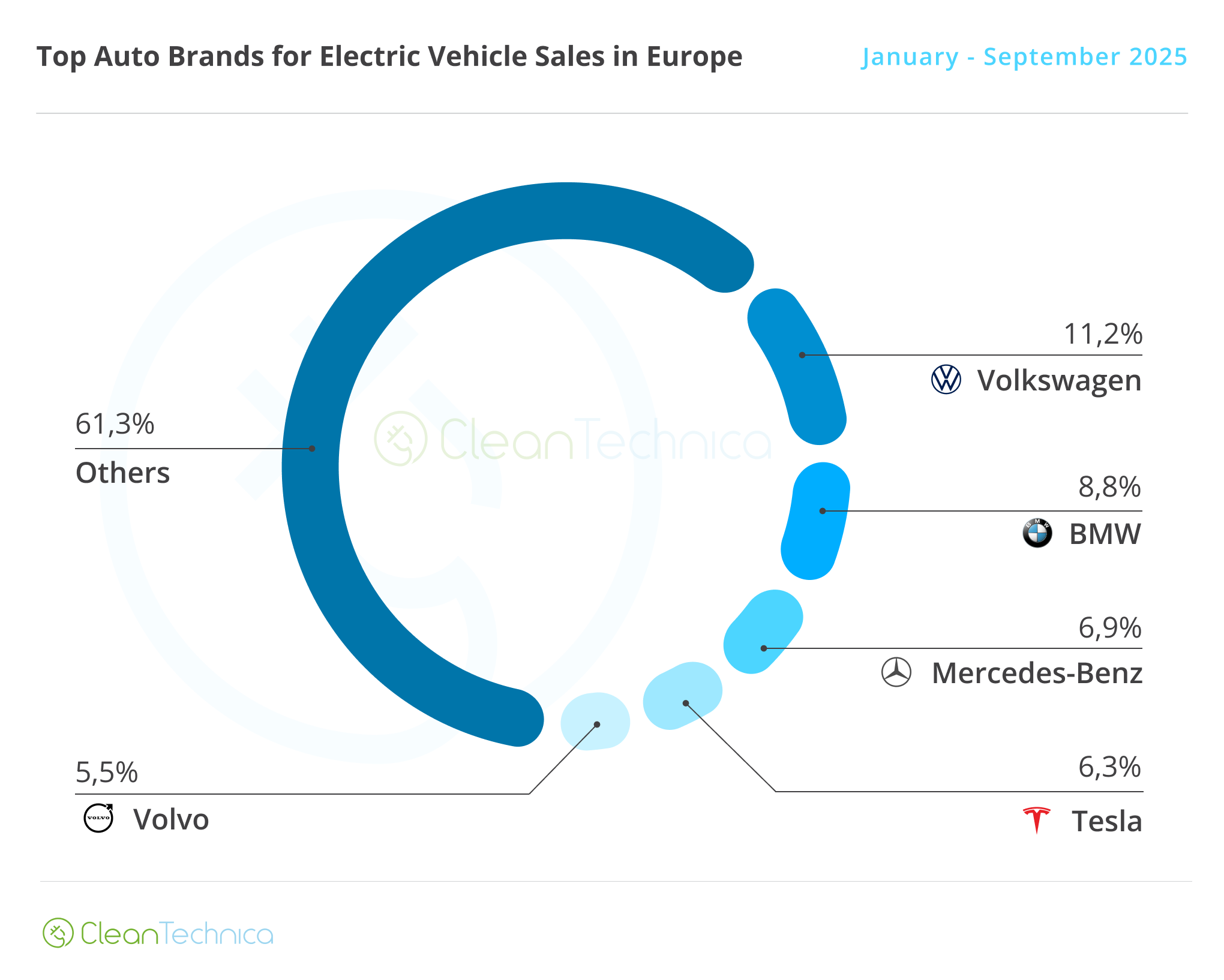

As for the plugin auto brand ranking, the leader, Volkswagen, remained firm (11.2%), holding a comfortable 2.4% share lead over #2 BMW, which lost 0.2% share and is now at 8.8%.

This means that the German make is on its way to ending a three-year Tesla reign in Europe (2022, 2023, 2024), winning its first manufacturer title since 2021.

Speaking of Tesla, the Texan automaker saw its share rise by 0.6% from 5.7% to 6.3%, keeping its #4 spot. Not bad, but … we are talking about the trophy holder. Tesla’s 2024 title was its 3rd in a row, and now it should end the year in 4th! The end of an era?

Below the top 5, a deserving mention goes to rising BYD, which saw its share grow to 4.6%, a 0.3 percentage point increase over August.

While a top 5 position for BYD seems almost a certainty, in 2026, we might even see BYD compete for the podium by the end of that year!

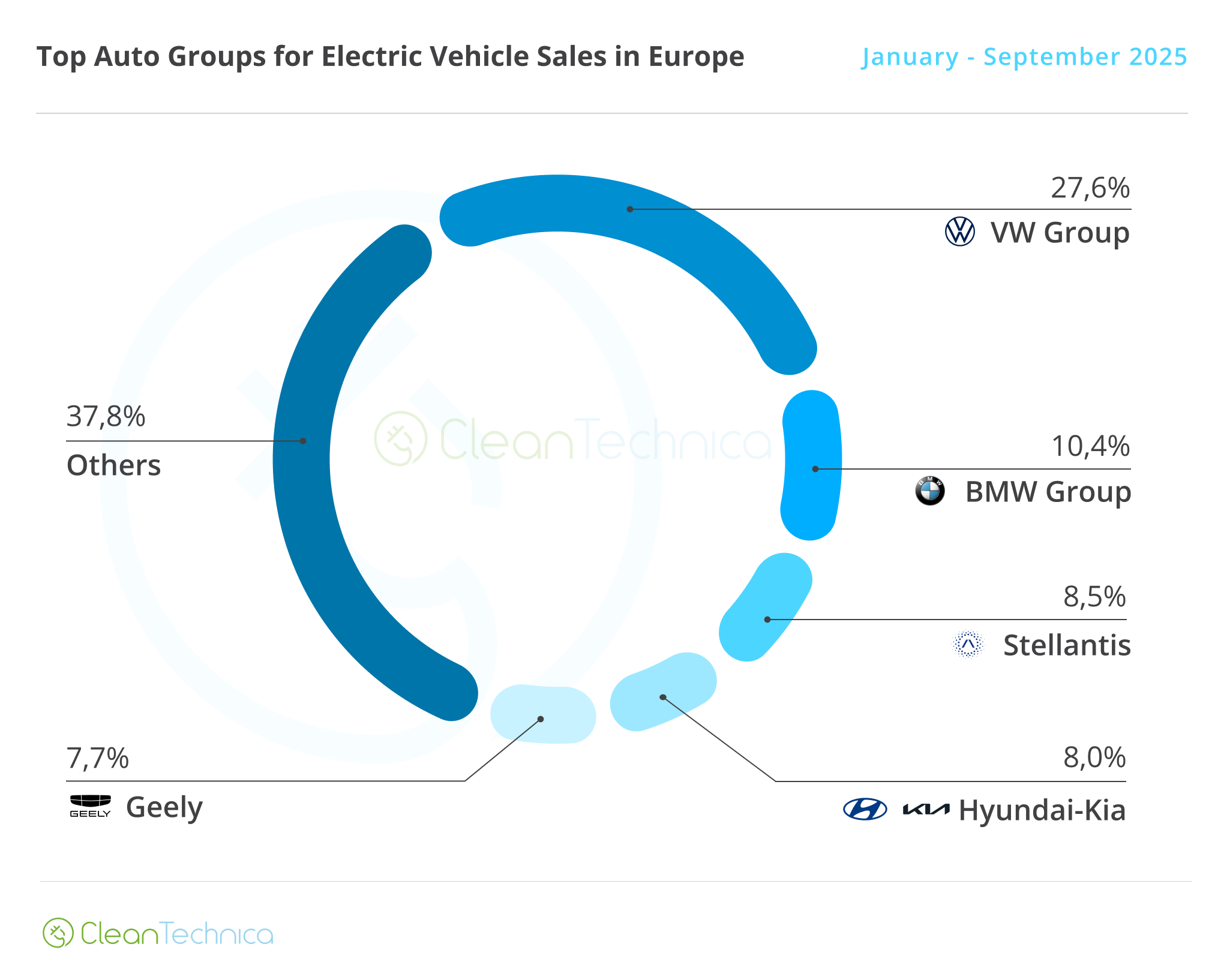

Arranging things by automotive group, Volkswagen Group is firmly in the lead, despite losing 0.2% share in September. It is now at 27.6% share, a market share that is comparable to BYD’s in China and Tesla’s in the USA. This is an important metric for the German conglomerate if it wants to stay relevant in a fully electrified global automotive market.

If you can’t win at home….

BMW Group (10.4%, down from 10.6% in August) remained comfortable in the runner-up position in September, while #3 Stellantis’ highway to hell seems to have no end (8.7% in August vs. 8.5% now). With too many brands and too little money to develop them, maybe it would be good to sell a couple of them?

There have been rumours that at least 50% of Maserati could go to Dongfeng….

But back to the top 5: Hyundai–Kia (8.0%, down 0.1% compared to August) remained in 4th, while #5 Geely (7.7%) remained stable.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy