Electric Motorcycles Take 10% Market Share of New Motorcycle Sales in Kenya in the First 8 Months of 2025

Support CleanTechnica’s work through a Substack subscription or on Stripe.

The KNBS Economic Survey Report (2025) covering the period from January 2024 to December 2024 shows that 68,804 new motorcycles were registered in Kenya in 2024. Of these, 4,862 motorcycles were electric according to data presented by the Electric Mobility Association of Kenya (EMAK). That means 7.1% of new motorcycle registrations last year were electric. This is pretty awesome given the fact that just a few years ago, the industry was initiated by a few innovators literally converting old internal combustion engine motorcycles in small warehouses in Nairobi’s industrial area.

The 5% threshold is generally considered the point where things start to accelerate in these kinds of transitions, and therefore the motorcycle sector market share being at 7% already is exciting. Given the lower total cost of ownership associated with electric motorcycles compared to their equivalents, this could be a key moment for electric motorcycles in Kenya. Players in the electric motorcycle industry could take advantage of this and really gain significant traction and market share going forward. I spoke with several motorcycle taxi operators in Nairobi recently, and from the feedback, you could tell that more motorcycle taxi riders in Kenya are starting to warm up to electric mobility, which will help. Asset financing companies are also increasingly supporting electric motorcycle financing. For example, Watu’s 2025 financing plans and targets are as follows:

- To finance 4,850 motorcycles in Kenya, with 2,000 of them being electric. That’s a massive 41% electric share!

- To finance 27,300 motorcycles in Uganda, with 3,600 of them being electric. That’s 13% electric.

We have some more good news. The overall motorcycle sales market in Kenya is starting to recover after a rough couple of years post-COVID 19. The overall motorcycle market in Kenya had been going through a rough patch where sales of new motorcycles in Kenya dropped from a peak of 285,203 in 2021 to just 68,804 in 2024. This huge drop in sales has been attributed to lower consumer purchasing power, which has reduced the daily utilization of boda bodas in Kenya, and consequently also reduced the daily unit profitability for motorcycle taxis due to higher fuel costs in recent times. Other factors include higher financing costs on top of increased sticker prices for some models. Data from KNBS shows that the market is now starting to bounce back, as fuel prices have fallen and stabilized a bit since then. The Kenyan shilling has also strengthened to “normal levels” of around 129 to the dollar, from 157 in December 2023. Another factor driving increasing motorcycle sales in Kenya is the surge in adoption of electric motorcycles as several players in this space — such as Arc Ride, Roam, Ampersand, and Spiro — ramp up deliveries of their electric motorcycles.

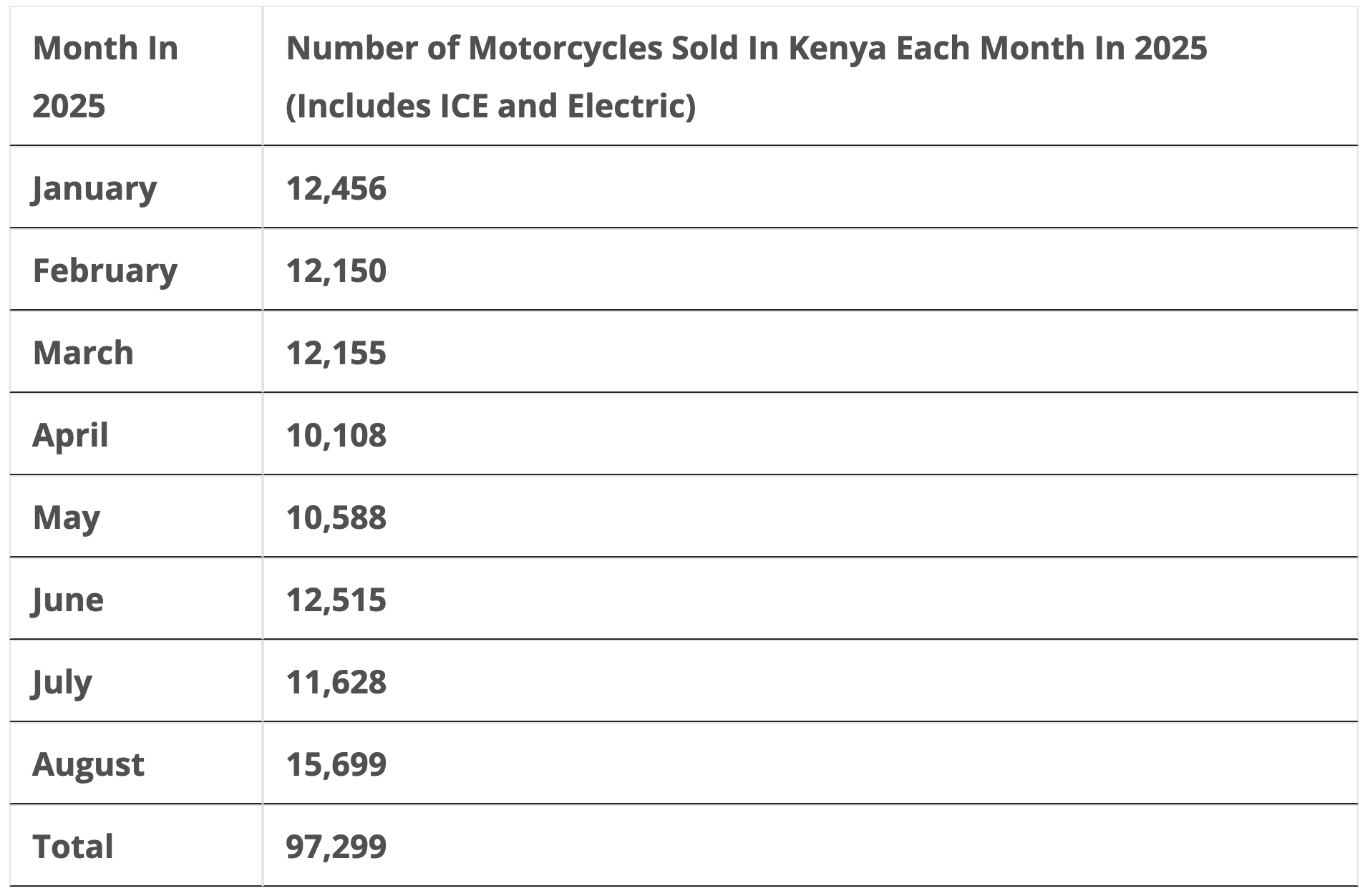

The latest KNBS Leading Economic Indicators Report for August 2025 shows that for the period from January 2025 to August 2025, 97,299 motorcycles were sold in Kenya. That means 28,495 more motorcycles were sold in the first 8 months of the year compared to the whole of 2024!

Here is the good news: 9,368 electric motorcycles were sold in Kenya from January to August of this year, meaning that 9.6% of all motorcycles sold in Kenya in the first 8 months of this year were electric! One of the leading players in the industry, Spiro, sold 5,390 electric motorcycles from January to August of this year, meaning that 5.5% of all motorcycles sold in Kenya in the first 8 months of the year were from Spiro. This is tremendous progress from Spiro and all the players that are active in Kenya’s electric motorcycle sector. The sector essentially went from 0% to 7% market share in about three years, which is really cool, and has now pushed on to 10% during the first 8 months of the year. With official data from September and October still to come, plus sales from the last two months of the year, and reports from several electric motorcycle companies suggesting faster ramp-ups in production for those months, we could see the market share for 2025 end up at around 15%. That would be tremendous progress. Let’s wait till the end of the year to see where we land.

We have been covering the developments in Kenya’s electric vehicle sector for over 7 years now — from the early days of a few startups converting one or two internal combustion engine motorcycles in small warehouses as mentioned earlier, to seeing the sector grow to almost 50 players in the industry. Now we are seeing market shares of 10%, and possibly 15% by year end. It’s super exciting to see all this progress in less than a decade. The industry has scaled much faster than most people thought it would, and all thanks to the hard work and dedication of startups that set out to electrify Kenya’s boda boda sector. With over 2.5 million ICE motorcycles registered in Kenya, accelerating the adoption of electric vehicles is good for Kenya. This will go a long way in reducing CO2 emissions in Kenya, an area where the transport sector is a big contributor.

Accelerating adoption also will also help solve some of Kenya’s key challenges in the energy sector. For example, an issue that has been affecting Kenya’s electricity landscape is energy curtailment due to low uptake of available geothermal generation capacity during the overnight off-peak hours. For the financial year that ended on the 30th of June 2025, EPRA reports that energy curtailment was reduced by 17.72%, from 812.8 GWh curtailed in the previous year to 668.7 GWh in the year ending June 2025. Still, 668.7 GWh is almost 5% of the energy generated during that period. Most of the energy curtailment happens overnight at geothermal plants. A good chunk of this could be better utilized through overnight charging of electric vehicles.

Another area of note is reliance on fossil fuel imports. Kenya’s demand for fossil fuels is now close to $500 million per month! That’s a huge chunk of Kenya’s total import bill. At this pace, in 12 months, Kenya would be spending $6 billion on fossil fuel imports! The continued reliance on fossil fuel imports is one of the main drivers of Kenya’s trade deficit. This is perhaps a perfect time to really catalyze the local electric mobility sector and to start to significantly reduce fuel imports by substituting those imports with locally generated renewable electricity to power electric vehicles.

Images by Remeredzai

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy