Support CleanTechnica’s work through a Substack subscription or on Stripe.

Over the weekend, BYD introduced a refreshed Han, increasing the battery range of the DM-I (PHEV) to 245 km (152 mi), almost doubling the battery range. That’s more than many early BEVs and enough range to cover typical weekly usage with a couple of charges. In addition, fuel efficiency once the battery is depleted increased to 3.44 l/100 km (68 mpg). On the BEV Han, range increased to 635 km (394 mi) on mainstream models and 705 km (438 mi) on the top spec, up from 605 km and 701 km on previous models.

While new product was being launched, China announced significant regulatory changes: in order to qualify for the purchase tax exemption, PHEVs would need to have a range of at least 100 km (62 mi) and BEVs would have to meet stricter efficiency targets. Several other regulatory announcements, particularly around pricing, and product announcements were also made over the weekend, with more anticipated. Looking at product and regulation together helps to illustrate BYD’s overall position in the changing Chinese market, with implications that extend beyond their borders.

A Better Value for the Money

Beyond the range, the Han refresh has led to significant overall improvements. DM-I power numbers stayed the same, but acceleration improved by a couple of tenths to 6.7s/100km. BYD’s “God’s Eye” C comes standard on mid-spec models, while it is optional on the entry-level model, potentially due to some local regulations that restrict ADAS use on car service vehicles. The LiDAR-based “God’s Eye” B system adds additional capabilities on the top spec models. In addition, all but the base DM-I Han now come with BYD’s DiSus C “intelligent body control” active damping system.

On the EV, while the 30 km range increase may seem somewhat small, squeezing more efficiency out of an already efficient vehicle is significant. In addition, they were able to increase performance, with 0–100 km/h decreasing from 7.9 seconds to 6.9 seconds, despite only minor increases in power (170 kW) and torque (360 N-m). The 30–80% charging time, while not up to Han L standards, has improved to 20 minutes. According to the launch presentation, efficiency is up to 10.6 kWh/100km, which is better than a Model 3 and many smaller cars under the same testing standard.

The interior adds a rear screen and refrigerator to most models. All but the base DM-I comes with heated, ventilated, and massaging seats. “Piano black” has been removed from the dashboard with a claimed improvement in materials. The shifter has also been moved from the console to the steering column, freeing up space. A widescreen heads-up display (W-HUD) comes on premium trim levels.

In terms of price, the new EV models come in at 183,800 to 215,800 RMB ($25,834–$30,331). The 245 km PHEV ranges from 169,800 RMB to 199,800 RMB ($23,866–29,083 USD). Compared to previous models, these prices are slightly more for a better equipped entry level to a little less for top trims. Of note, those list prices are before a 10,000 RMB trade-in subsidy and other discounts. Overall, the value has increased, while the price gap between comparable PHEV and BEV models has shrunk. Due to the increased battery range, the gap in EV usage also stands to shrink. For comparison, a smaller entry-level Model 3 starts at 235,500 RMB in China, higher than the top spec Han.

Regulators Raise the Bar

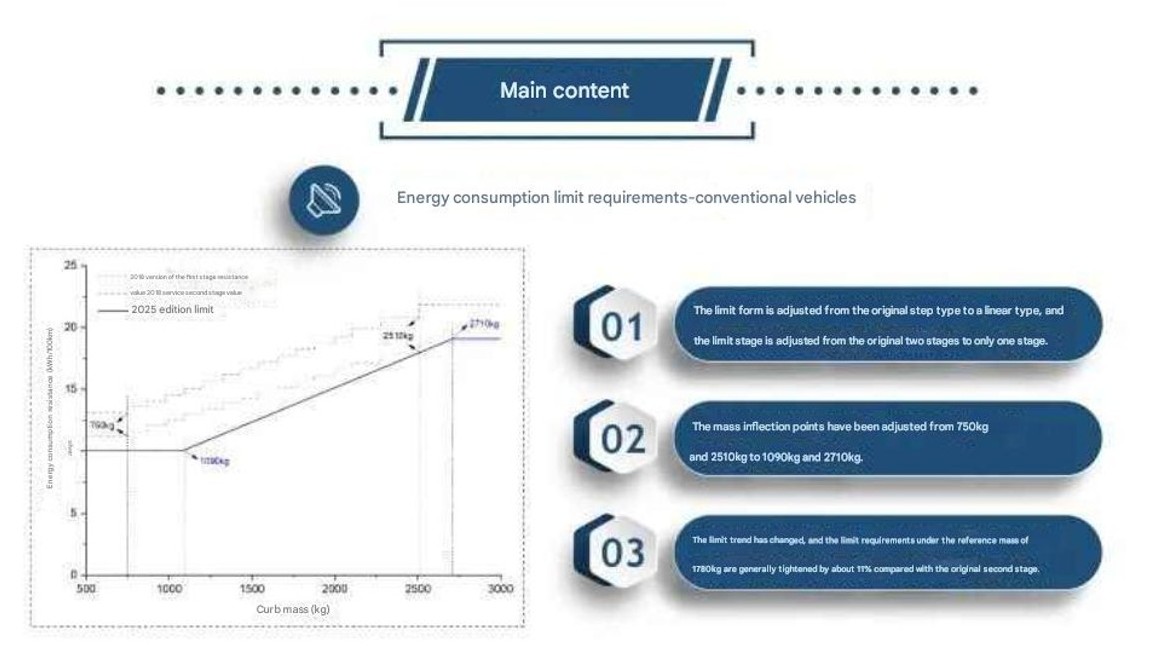

Over the weekend, GB 36980.1 – 2025 was announced, regulating which vehicles qualify for the NEV purchase tax exemption. PHEVs will need at least 100 km of battery range (up from 43 km). It has been estimated that roughly 40% of current PHEVs being sold in China do not meet the new standard. According to the efficiency graph from MIIT for electric vehicles, efficiency would need to rise to roughly 10 kWh/100 km for vehicles less than a metric ton, up to roughly 19 kWh/100 km for vehicles 2710 kg and over, roughly 11% higher than before. While this may not impact most mainstream EVs in China, it will potentially exclude some large, thirsty EVs. Overall, the exemption is being halved from the full 10% purchase tax to 5% starting next year. It is anticipated that multiple automakers will be clearing out existing inventory this quarter, before their vehicles become ineligible.

However, while those range and efficiency numbers will be hard for some companies to meet, the world’s strictest battery fire regulations (GB 38031-2025), announced earlier this year, could make it more complicated. As of May, only BYD and CATL LFP batteries met the standard. Automakers trying to increase vehicle range by adopting more energy dense ternary batteries will also have to deal with increased fire risk associated with the chemistry. Multiple tests and requirements are involved in meeting the standards. Some battery suppliers may have difficulties, and we could see consolidation. From July 2026 on, all new EVs will need to meet the standard. That isn’t much time and could lead to significant market implications.

Emissions regulations are also anticipated to become stricter soon with the adoption of China 7 emissions. The previous China 6 was harmonized with Euro 6 emissions. China moved up to stricter China 6B last year in anticipation of planned changes for Euro 7. However, Euro 7 was relaxed from earlier plans due to automaker complaints, leaving China with the strictest emissions in the world. Of note, China has tended to make emissions stricter for both new and existing cars, which could lead to a wave of ICE scrappage. Having the strictest emissions standards in the world become even stricter makes ICE compliance a challenge, shifting the market to electrified vehicles.

While those regulatory changes will make it harder for some companies to conduct business profitably, they also will have a harder time operating at a loss due to new policies intended to address “involution.” Automakers will find it harder to liquidate outdated vehicles at a loss or use money losing prices to drive volume. As anticipated, Beijing also announced that it is stepping up measures to address price wars, as reported in Bloomberg late last week (reposted in Business Times).

“To address the issue, the regulators will step up cost investigations, price supervision and enforcement actions against rule breakers, according to the notice. Companies which are found to persist in illegal pricing after formal warnings could face further scrutiny or penalties.

“Companies, especially in sectors with prominent pricing issues, must price goods and services “fairly and lawfully” in line with market supply and demand, the regulators said, reiterating that the current rules prohibit companies to bid below cost in tenders and other procurement processes.”

BYD Benefits From Proactiveness

Overall, the combination of new product introductions and regulatory changes adds further context to what’s been happening with BYD sales. In addition, BYD announced over the weekend that it would be phasing out its once best-selling Song Plus to be replaced by the Sealion 06, as previously indicated, with the model continuing in overseas markets. In addition, the 2026 Seal 05 DM-I was launched with battery range almost doubling to 128 km at the same price point, easily exceeding the new regulations. Overall, the majority of BYD’s models, especially in the Dynasty family, are seeing refreshes this fall.

We have become accustomed in the West to many automakers having an adversarial relationship with regulators, often proclaiming that stricter regulations are impossible. Conversely, BYD has a history of working with regulators, often making changes proactively and showing that regulations are possible. Chinese regulators frequently imply that changes are coming, and automakers ignore those hints at their own peril. When you see a sweeping change to BYD product like the Han in a timeline that seems out of place in China (updates traditionally launch in 1Q), there is a good chance that regulatory changes are coming. In addition, rather than reactively responding to regulation, they seem to proactively address anticipated changes, comfortably exceeding them and increasing the performance of premium models to provide a differentiating level of performance on those metrics.

Vertical integration and the largest R&D staff let BYD respond faster and stay ahead of regulations, as well as provide research on how to improve them. Several competitors will need to work with an array of suppliers to make significant changes to their vehicles, often with a reactive approach that makes timely compliance difficult. However, the vertical integration also helps BYD to control costs. Not only does BYD make its own batteries, motors, suspensions, brakes, etc., but also the ADAS, comfort, and infotainment systems. Typically, higher trim levels have much higher margins, even though much of the content that makes up those trim levels comes from suppliers at most other automakers. This is part of why it becomes hard to reduce prices by decontenting. However, by increasing the content with features that they produce in-house, BYD can increase perceived value far more than costs increase. Offering a loaded vehicle up against a stripped-down vehicle at a similar price has appeal to many. The resulting “value war” is a war they are in a much stronger position to win than a “price war.”

BYD has been the most profitable automaker in China, with higher gross margins than most of the global industry. It is in a good position to show prices above costs. However, several startups have increased sales as losses have increased, which is unsustainable. As such, some consolidation is expected, which the new regulations are likely to accelerate. However, this could also impact established players. SAIC and GM have been losing money on their joint venture and GM still has not become profitable on its own EVs in terms of cost of goods sold (only variable costs, excluding fixed costs). With the joint venture under negotiation for renewal and an inability to sell at a loss, could the changes lead to a GM exit?

Global Implications

Overall, new regulations will make it more difficult for some automakers to operate in China, while the remaining automobile market becomes more sustainable financially and environmentally. While BYD seems ahead of the regulatory curve within China, domestic sales have seen a decline. This is likely due, at least in part, to changes made ahead of the regulatory announcements.

However, export sales have shot up, especially in some markets, while overseas production expands. We are likely to see more BYD cars globally, but they will not be alone. Other automakers are looking to expand outside of China, and the stricter regulations will likely add some urgency to those plans. However, China is also implementing new export licenses that should help to prevent abuses.

Over the weekend, it was also announced that Chinese imports and exports rose significantly above expectations, despite the trade spat with the US. Also over the weekend, China said it would eliminate tariffs on Canadian canola if Canada removes them on EVs, with Foreign Affairs Minister Anand headed to Beijing.

We are likely to see more Chinese cars on the road globally. However, the Chinese automobile market is larger than the US and EU markets combined, with roughly two thirds of all EV sales globally. Despite protectionist measures, that scale shapes global product for manufacture and supplier operations in China. A couple of decades ago, you might have noticed that engines used to have a wide range of displacements (1.6l, 2.2l, etc.), and then smaller engines seemed to fall into half liter buckets (1.5l, 2.0l, etc.) This wasn’t by accident, but a reflection of China’s displacement-based consumption tax that went up progressively in half liter increments. We could see a similar pattern with the new regulations for any company that has business in China. However, if companies retreat from China into protected markets, the reduced scale and competition could negatively impact both long-term business performance and product performance.

We may see some models that are no longer viable in China being sold to global markets for a while. However, we should also soon see PHEVs with greater range, more efficient EVs, and safer batteries in global markets. This could lead to the demise of ICE-centric “fake PHEVs” and address many of the issues with current PHEV usage. The increased competition could also lead to more advanced BEVs globally, even as some countries retreat.

Despite the rhetoric, regulation can lead to healthier industries that are more sustainable, even if there are temporary challenges. Raising the regulatory bar can stimulate proactive companies to strive harder to stay above it. The countries that lead on sustainable regulation are more likely to take a leadership position in global markets.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy