Finance Commission introduces new parameter of contribution of state to GDP in horizontal devolution

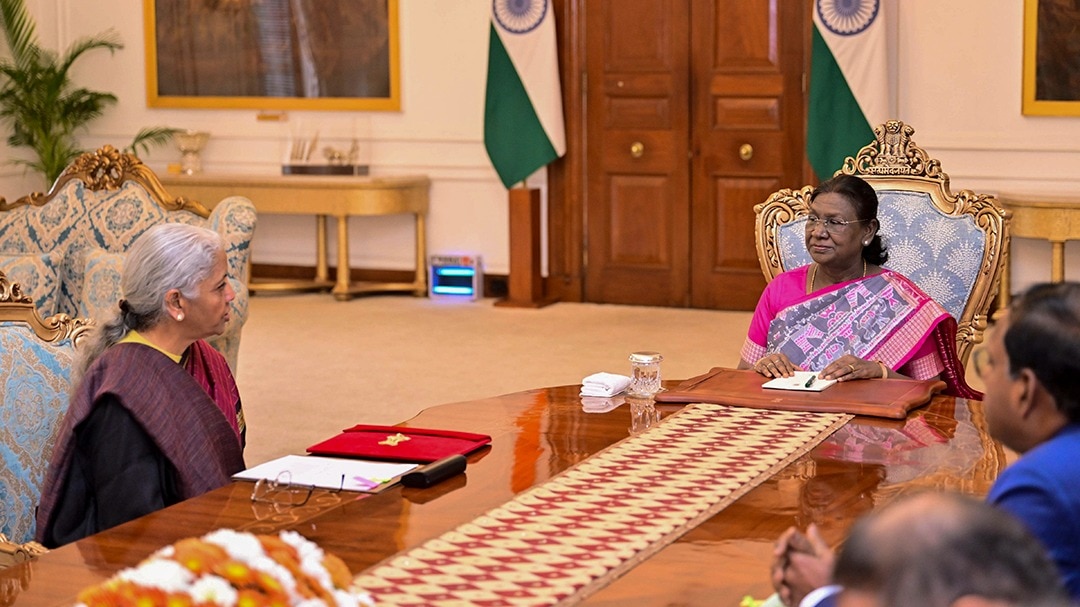

The Sixteenth Finance Commission has recommended that the states’ share in the divisible pool is retained at 41% but has recommended several significant changes that could impact the allocation of funds to them. The report of the Finance Commission was tabled in Parliament on Sunday by Finance Minister Nirmala Sitharaman after presenting the Union Budget 2026-27 along with an action taken report.

To determine the inter se share of states, the Sixteenth Finance Commission included a new parameter of contribution of the state-to-the gross domestic product (GDP) in horizontal devolution criteria.

Budget 2026 LIVE Updates: Ministry of Jal Shakti witnesses biggest spending rollback

“…with growing ambition of the country as the backdrop, due recognition must be given to efficiency and especially the States’ contributions to growth. Accordingly, for the first time, this Commission decided to add the State’s contribution to GDP among its horizontal devolution criteria,” it said in its report. Taking cognisance of the principle of gradualism, the Commission decided that the weight assigned to the criterion should be such that it spells only a directional change without causing a drastic shift in the States’ shares. Accordingly, a weightage of 10% of the total 100 was given to this criterion.

In all, it relied on population based on 2011 Census (weightage of 17.5%), demographic performance (10%), area (10%), forest (10%), per‑capita‑income‑distance(42.5%), and contribution of the State to Gross Domestic Product (GDP) as criteria.

It has also recommended that to bring in more transparency about the divisible pool and the actual devolution, the government should every year disclose the data pertaining to net proceeds as certified by CAG under Article 279.

Further, the Commission recommended that States should comply with the Constitutional provisions pertaining to the regular constitution of State Finance Commission (SFC) on the expiry of five years from the formation of the previous SFC and ensure laying of the Action Taken Report (ATR) in the State Legislature within 6 months of submission of the SFC report.

The Commission has also recommended that States’ fiscal deficit should be capped at 3% of their respective GSDP (excluding loans under SASCI) and to ensure the stability of the debts of the State Government, this should be strictly enforced in accordance with clause (3) of Article 293 of the Constitution. The Union Government should reduce its fiscal deficit to 3.5% of GDP by the end of the award period.

The government said it has accepted in-principle, the recommendation of the quantum (expressed as a per cent of GSDP) of net borrowing ceilings for the States. Other recommendations of the Commission including those related to Off-Budget Borrowings, amendment to State FRLs, union government fiscal deficit will be examined separately, it however, said.

The recommendations of the Sixteenth Finance Commission cover the financial years 2026-27 to 2030-31, commencing from April 1, 2026.

For FY27, the total resources shared, tax devolution and FC Grants, with States through the Finance Commission route are estimated at ₹16.56 lakh crore in BE 2026-27. In BE 2026-27, tax devolution to the States is estimated at ₹15.26 lakh crore compared to ₹13.93 lakh crore in RE 2025-26, which includes an additional amount of ₹9,084.02 crore on account of dues receivable by the Union Government from States under devolution from the previous years. Tax devolution to the States in BE 2026-27 is 3.9% of GDP and ₹1.33 lakh crore more than tax devolution of RE 2025-26 (including past arrears).