The truckload sector has been stalled in a freight recession for some three years now, but recent Trump Administration efforts to raise cargo-hauling rates by shrinking excess vehicle capacity have not yet begun to bear fruit, studies show.

In a market where observers say there are too many trucks competing to haul a shrunken pool of freight, shippers have been able to move their loads for cheaper rates than usual. The White House aims to tip the scales of that imbalance by reducing the number of trucks on the road through imposing stronger standards for commercial driver training, licensing, and qualifications, according to the Owner-Operator Independent Drivers Association (OOIDA).

In a letter sent Monday to U.S. House and Senate transportation committee leaders, OOIDA threw its weight behind those efforts, which includes what it calls “commonsense reforms” such as: enforcing English language proficiency rules; rnsuring integrity in non-domiciled CDL issuance; strengthening entry-level driver training; and rejecting efforts to lower professional standards.

Those initiatives can be seen in recent initiatives from the U.S. Department of Transportation (USDOT) and Federal Motor Carrier Safety Administration (FMCSA) such as moves to restore English Language Proficiency violations into the Out-of-Service Criteria and an Interim Final Rule (IFR) restricting the issuance of Non-Domiciled commercial driver’s licenses (CDLs), which are licenses granted by states to drivers without an address there.

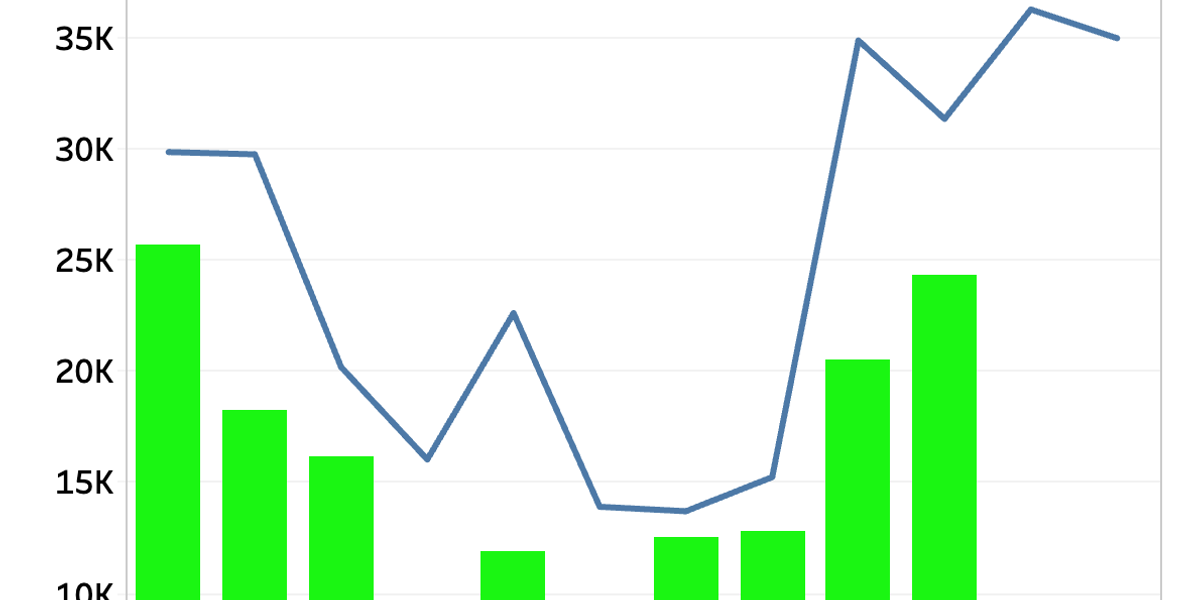

Express say those steps could potentially shrink the number of drivers—and trucks—on the roads, but change will take time. For example, transportation analysis firm FTR forecasts that its Trucking Conditions Index (TCI) will show improved market conditions for truckers in 2026 and 2027, but in the meantime, that measurement improved only slightly to an “essentially neutral” 0.3 in August from -1.03 in July, thanks to marginally less challenging freight rates.

“The potential for a capacity-driven recovery in trucking has risen over the past month due to severe restrictions imposed on issuing and renewing commercial driver’s licenses for foreign drivers,” Avery Vise, FTR’s vice president of trucking, said in a release. “However, despite some anecdotal reports about various effects of a crackdown on immigrant drivers, available data has yet to show a substantial impact on market conditions. We expect pressure on foreign drivers to be a significant factor for capacity in the coming months, but many questions remain about the scope and speed of the effects of tighter CDL and English language enforcement on the truck freight market.”

Likewise, financial analysts with TD Cowen said today that the new non-domicile rules could have higher capacity impact than previously believed, but only if they are rigorously enforced across a handful of critical states with high populations. “Enforcement in IL, CA, WA is key as data shows these have been outsized contributors to capacity and continued sizable CDL issuance in ’25,” the firm said in a note to investors. “We continue to believe enforcement will take time but the DOT appears willing to do so and conditions seem conducive for a strong ’27 bid cycle.”

That level of enforcement may be more easily said than done, however, since other voices in the industry point to potential downsides like an outsized impact on disadvantaged populations, job losses, and disruptions to current flows of imports and exports.