American manufacturers continue to report “a mixed bag” of economic challenges, according to the National Association of Manufacturers (NAM)’s Q4 2025 Manufacturers’ Outlook Survey.

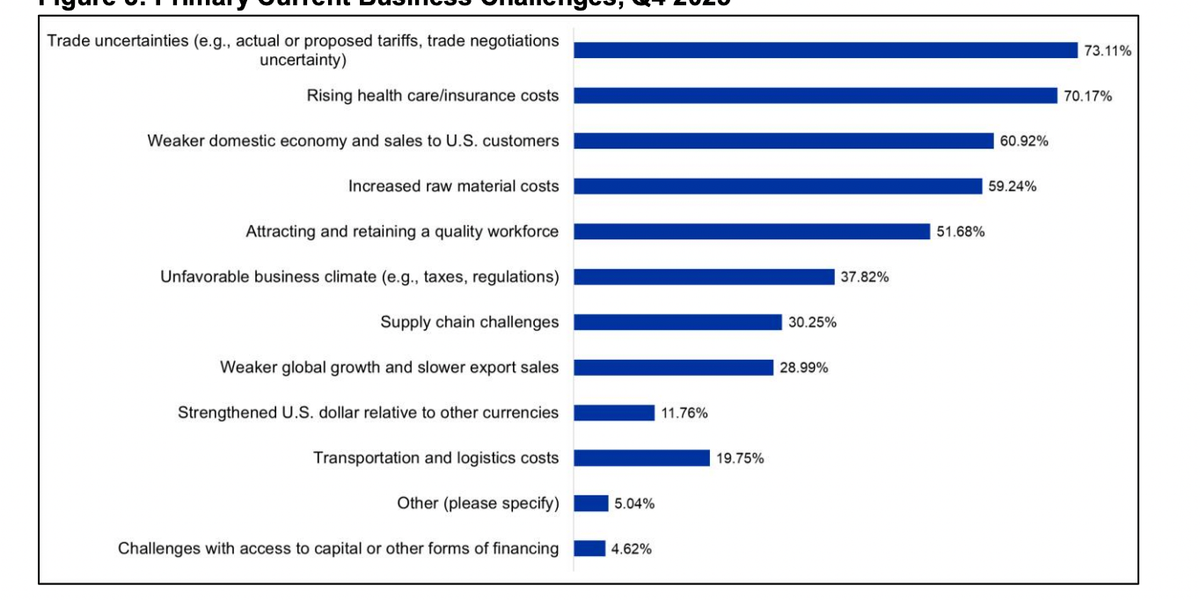

In the quarterly survey, manufacturers applauded certain Trump Administration policies like regulatory changes and tax levels in the One Big Beautiful Bill Act (OBBBA). But they also flagged other presidential policies as top business challenges, such as looming trade uncertainties (73.1%), rising health care costs (70.2%), and a weaker domestic economy (60.1%).

“In line with the improvement in the outlook, companies expect most indices to improve marginally over the next 12 months,” NAM Chief Economist Victoria Bloom said in a release. “For example, manufacturers predict sales will increase 2.8%, up from 2.6% in Q3, and capital investments will grow 1.4%, up from 1.0% in the prior quarter. That said, while sentiment has improved, we are still below the historical average of 74%.”

Other survey findings included:

- A majority of manufacturers (80.3%) report paying tariffs on imported manufacturing inputs since the start of 2025, led by 58.6% of respondents paying Section 232 tariffs, 52.1% paying reciprocal tariffs on other countries under the International Emergency Economic Powers Act (IEEPA) and 50.0% paying Section 301 tariffs on China.

- Tariffs are impacting manufacturers of all sizes, with 72.8% of small and medium-sized manufacturers with fewer than 500 employees paying tariffs on inputs this year—alongside 97% of large manufacturers.

- When it comes to hiring needs, 72.1% of respondents cite skilled production workers (technicians, welders and machinists), 60.1% point to core production workers (operators, assemblers and packaging) and 33.5% say they need high-skilled, degreed workers (scientists, researchers and engineers).

- Climate disclosure regulations are costing manufacturers, with more than one-third (38.2%) of manufacturers subject to new international or state laws and regulations requiring disclosure of emissions and climate risks. Of those respondents, 91.6% face increased reporting costs and are diverting funds from productive uses to pay these added costs.

- 82.3% of respondents indicated it is important to their companies for Congress to pass legislation maintaining robust, multiyear infrastructure investment to support manufacturing.