Support CleanTechnica’s work through a Substack subscription or on Stripe.

These are fraught times for battery manufacturing in the US. The bozos in charge of the country are using all means fair and foul to suppress demand for electric cars and renewable energy. Fortunately, the One Big Beautiful Bill the Repugnicans rammed through Congress earlier this year did preserve federal tax credits for energy storage, but the softening of demand for electric cars after the federal tax credits expired at the end of September is inflicting economic pain on the industry.

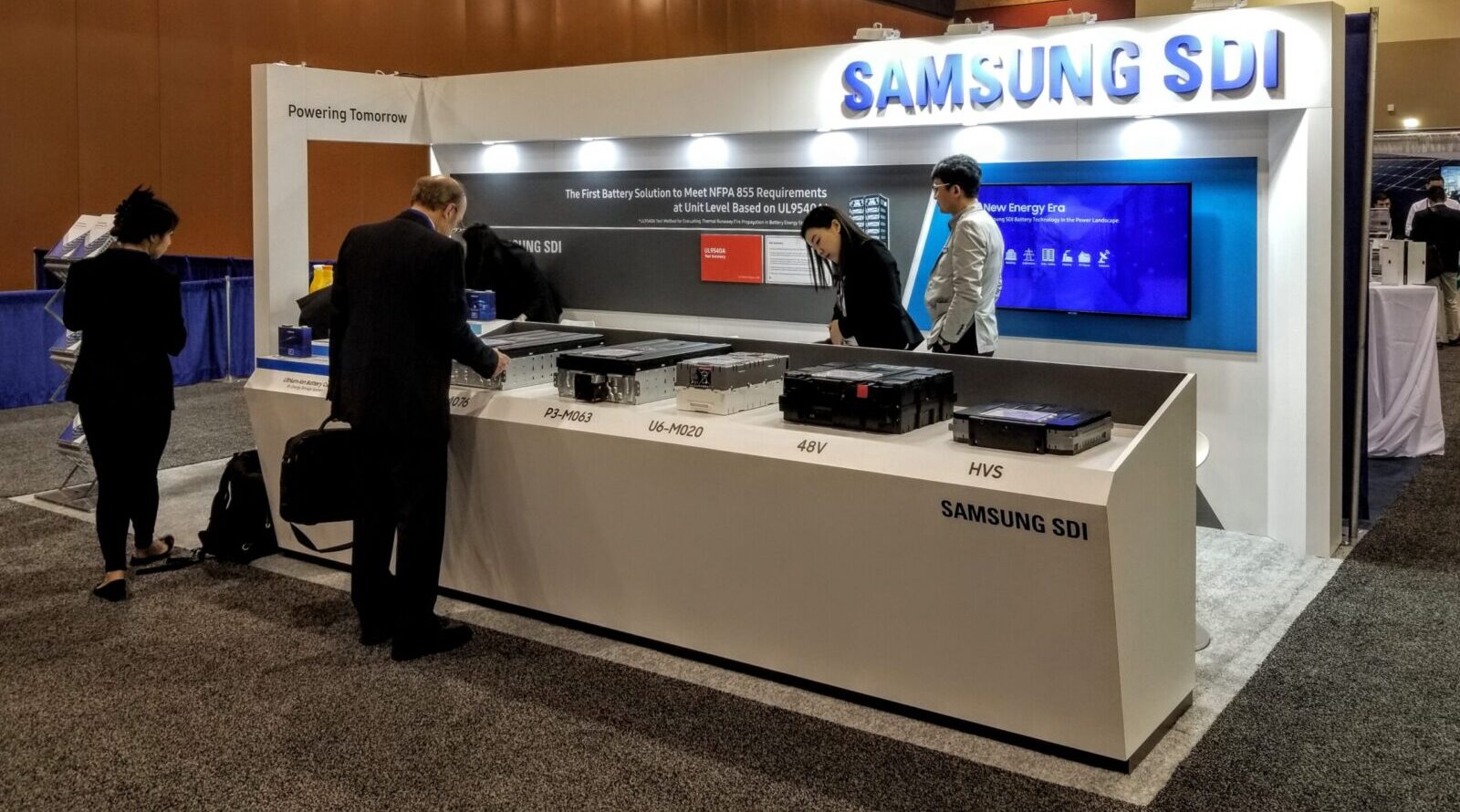

The Detroit News is reporting this week that construction of a battery factory being built by GM and Samsung SDI in New Carlisle, Indiana, has been slowed due to an expected decline in EV sales in the US, resulting in the layoff of workers. Perhaps they got lucky, as all they lost was their jobs. Earlier this year, hundreds of specialists from South Korea working on a similar factory in Georgia were hauled off to prison by ICE goons, who shackled them hand and foot so the press could get lots of photos of the scary immigrants being carted off to jail.

Barton Malow, the primary contractor for the battery factory, has confirmed the layoffs at the $3.5 billion project but declined to provide specifics, including how many workers were let go and how many remained onsite. It said in a statement that it “recently had to layoff some of our workforce” and that such cuts are “an unfortunate part of the natural ebb and flow of the construction business.”

“We recognize the impact it has on our team members and their families, and commit to supporting them through this transition and working to get them back onto this or another project shortly,” the statement by spokesperson Eric Fish said. GM spokesperson Kevin Kelly confirmed some workers were taken off the project but declined to provide specifics. He said construction continues.

Bill Schalliol, director of economic development for St. Joseph County, said the construction slowdown comes as GM and Samsung consider making design changes to the project, with the possibility that it could manufacture a different kind of battery altogether. He said this week there is still some construction activity going on at the 680 acre site, which is just south of the Michigan border and west of South Bend. Most of the steel frame for the two buildings is in place, he said, and installation of wall panels began recently.

The factory was originally designed to make nickel-rich prismatic batteries, but without the tax credits, manufacturers in many cases are turning to lithium-iron-phosphate batteries. Although LFP batteries are not as energy dense, they do have the advantage of costing less to produce.

LFP Vs. NMC

The second-generation Chevy Bolt is said to use LFP batteries in place of the more expensive batteries used in its first-generation cars in an effort to keep the price of the new cars as low as possible.

LFP batteries do have several advantages over their more expensive cousins. For one, they are far less likely to experience “thermal runaway events” — which is how the industry refers to battery fires. For another, they are far more tolerant of being fully charged on a regular basis — a plus for drivers who have become accustomed to only charging their batteries to 80 percent on a regular basis.

News of the slowdown comes as GM aggressively cuts other EV costs and pushes more money back into gas-powered trucks and SUVs, The Detroit News report said. “Policies promoting EVs have been rapidly dismantled under President Donald Trump and before that customer demand hadn’t matched initial projections. The company said earlier this week it was laying off thousands of workers who make EVs and batteries across several sites — including at its existing joint-venture Ultium Cells battery plants in Ohio and Tennessee.”

The battery factory was originally scheduled to be completed in 2027. But now completion is expected to occur closer to the end of 2027. Eventually, the battery factory is expected to employ 1,600 workers.

“We’re playing the long game,” Schalliol said. He added that he is confident the plant will begin operating eventually. GM didn’t spend all the money on the project “to convert this into the world’s largest pickleball facility,” he joked.

Dan Caruso, who lives about a mile away from the battery factory, told The Detroit News that with construction activity slowing down noticeably, he doubts it will be operational by 2027. “I don’t see any way, especially with the current environment, with the direction of (Trump’s) ‘drill baby drill,’” he said. “They’re not going to get the energy credits they need to put a battery plant in place.”

He has a point. Congress left tax credits in place for energy storage, but the credits for EV batteries are now a tangled mess, thanks in part to Elon Musk and his chainsaw wielding pals at DOGE.

Samsung & Tesla BESS News

But with BESS incentives intact, Samsung SDI said on Tuesday it is in talks to supply energy storage batteries to Tesla — an order that could be worth more than $2 billion, according to Investing.com, whose reporting was based on Korean news sources. It said, “A deal would mark the latest push by Tesla to reduce reliance on China for key parts, fueled by tariffs and geopolitical tensions. Tesla has signed deals with Samsung Electronics and LG Energy Solution to source chips and batteries in recent months.”

LFP batteries have become the default choice for battery storage. Although they have lower energy density, they cost less and energy storage installations seldom have to deal with space constraints the way automobile designers do.

Samsung SDI said in an earnings call in October that it has seen a big fall in automotive battery demand from joint venture partner Stellantis, and will tweak some of its production lines in Indiana to make energy storage batteries. A source told Reuters that Tesla and Samsung SDI are discussing supplies of energy storage batteries, while another person said that the annual supply volume would be 10 GWh.

The South Korean newspaper Korea Economic Daily, which first reported the potential deal, said the three-year supply deal would be valued at more than 3 trillion won, or slightly more than $2 billion. A Samsung SDI spokesperson said the deal and its details have not been finalized yet.

Tesla said in an earnings conference call in October that its energy storage business is seeing headwinds due to the increase in competition and tariffs. “Currently all sales procured are from China while we’re still working on other alternatives,” it said.

The key for battery energy storage today is to try to break free of the stranglehold China has on the production of battery materials — a specialty western countries were only too happy to allow China to control until they realized belatedly what a bad idea that was. Now the plan is to bash China rather than delve too deeply into why no one thought to develop domestic supplies themselves.

One might assume a painful lesson has been learned and those same western countries will not make the same mistake in the future. Although, there is very little evidence to support that notion.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy